Award-winning PDF software

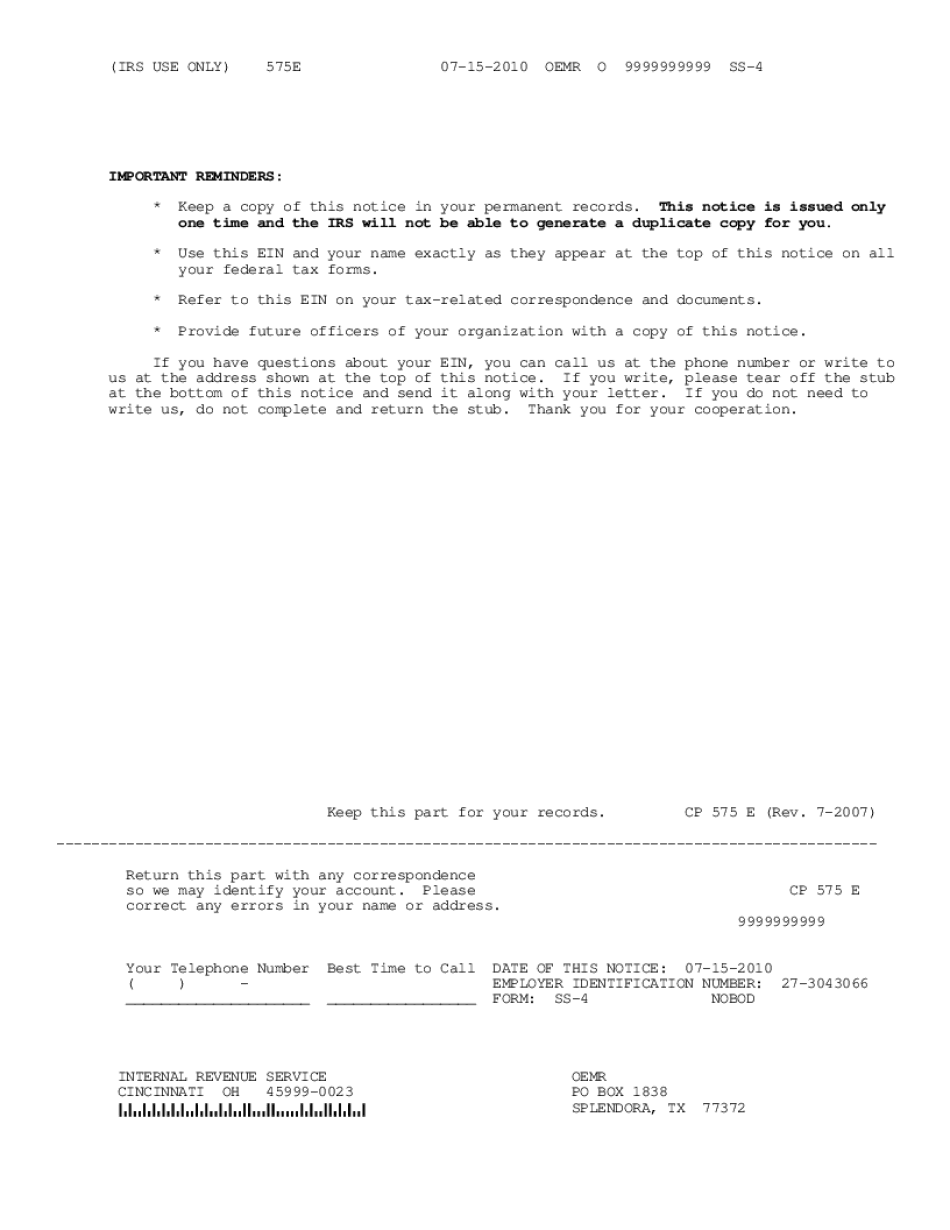

Printable Form 575E High Point North Carolina: What You Should Know

TEXAS Filing Tax Filing your taxes is easy when you use one of the many online federal tax preparation and filing programs that provide online access and make tax filing and payment convenient and convenient. Tax preparation is free and ready in as little as a few minutes; you can make a payment quickly and easily to save time and stress. The IRS offers a variety of online services and solutions for tax preparation and filing, including: Free Application for Federal Student Aid (FAFSA) Form 1040EZ Form W-2 Form 8606 for Social Security and Medicare Individual Tax return Progressive Federal Income Tax Calculator Free Publication of Federal Tax Returns Taxpayers are entitled to receive the Federal Tax Information Paperwork Reduction (Form 8505) free of charge. You must sign a declaration stating that you will give the IRS all information it needs to prepare your returns for you and to provide you with a printed copy of your return. However, if you have questions that have not been answered in the form, please contact us at, Monday through Friday, and between 8 a.m. and 4:30 p.m. Eastern time. Please note, you must first visit IRS.gov and create a login before you will be able to begin to use your e-file account. If you already have an e-file account, you will be limited to using your original login and email address, and no other e-filing account can be created. Taxpayers who cannot use an e-file account because their address cannot be found or because it's not registered in the system can contact their local Taxpayer Advocate service to obtain assistance in filing a return online. For detailed information about filing your tax return, see: Form 941: Federal Tax Return for Individuals Form 8505: Free Electronic Federal Tax Return Filing for Individuals Filing your federal income tax return electronically is quick and easy. You can file electronically with the IRS Online Federal Return (Form 86001). Taxpayers can create a free e-file account if you do not have an account, but a login, or if you have already registered with the IRS online system but don't yet have a valid e-file address.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 575E High Point North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 575E High Point North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 575E High Point North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 575E High Point North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.