Award-winning PDF software

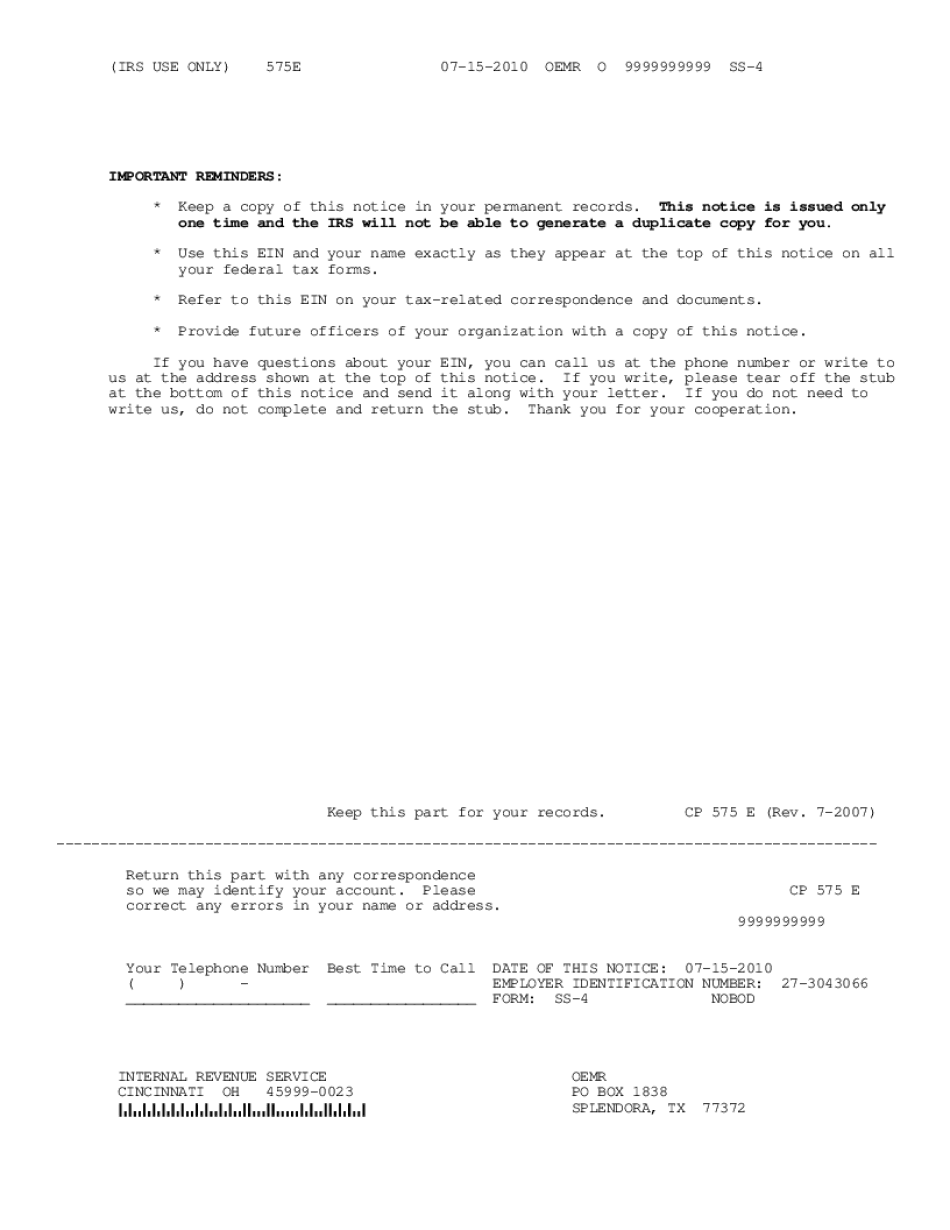

Form 575E Jurupa Valley California: What You Should Know

Get it online (PDF), download the form (MP3) or print (PDF). The forms must be received by the registrar's office before registration can be processed. You cannot take the rebate payment to a DMV office, since registering a vehicle is required once a payment is received at the DMV. Useful information — Fontana California Water Company If you have been in the Fontana, California water company system for more than thirty (30) years, and still have not received a letter from the board of directors stating whether you are or have been appointed CEO, or Director of Operations. Read about these requirements (PDF). About Taxpayer Assistance Program The Federal Public Utility Tax Assistance Program (“PUPA”) is a program administered by the Internal Revenue Service (IRS) to provide certain tax credits, deductions, and rebates to water service customers. A tax credit of up to 250,000 may be available to water and/or wastewater systems with a total annual revenue of less than about 750 million. In addition, a separate credit of up to 150,000 is provided to owners of water systems which are in fiscal health to demonstrate that the current state or federal rules and regulations have been followed. For more information on the Federal Public Utility Tax Assistance Program, please visit the IRS website at . The Fontana, California Water Company has received federal certification for Federal Contract, Federal Grant, and Federal Self-Sufficiency (Fiscal Year 2025 and 2003) (PDF). The company is also certified to collect Federal Unemployment Tax Act (FTA) (PDF) and California Unemployment Tax Act (Cal UTA) (PDF). The Federal Tax Assistance Program has been administered since June 1, 1986, and is administered by the Arizona Office of the Attorney General, and the IRS. Since August 1, 2009, the Federal Tax Assistance Program has been administered by the California Office of the Attorney General. If you have any questions, please call the California Office of the Attorney General at (800) 651–2950 and press 1. The Federal Tax Assistance Program provides certain tax exemptions and additional credits to qualified non-profit organizations, including government agencies, private corporations, nonprofit foundations and public institutions.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 575E Jurupa Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 575E Jurupa Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 575E Jurupa Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 575E Jurupa Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.