Award-winning PDF software

Form 575E for Tampa Florida: What You Should Know

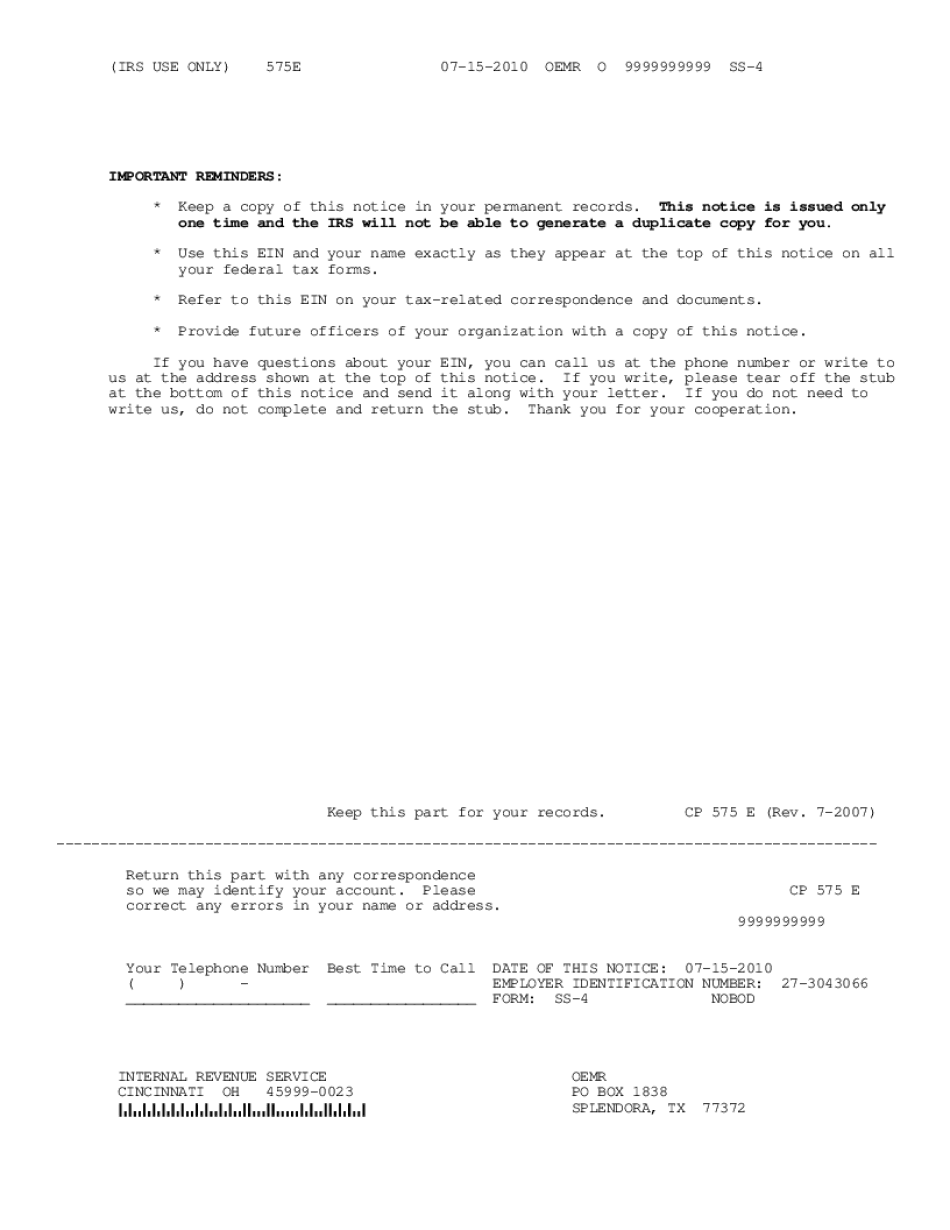

May 2025 — The fee for processing an application, which will be determined by the applicant, must be paid to City of Tampa by 5:00 p.m. on the date it was filed except for those applications for which a fee has already been paid. 17 Nov 2025 — The fee to process an application, which will be determined by the applicant, must be paid to City of Tampa by 5:00 p.m. on the date it was filed. Contact us for an application check or call us at :. 10 Feb 2025 Applications and Forms • City of Tampa CP 575-F Notice — International Organization The notice is for the organization to notify the IRS that it no longer requires a certificate of authorization to conduct business as a non-commercial entity based on an international convention or treaty. CP 575-E Notice — International Organization The notice is for the organization to notify the IRS that it no longer requires a certificate of authorization to conduct business as a non-commercial entity based on a convention or treaty or to conduct business as a small entity based on either a foreign or domestic treaty or convention. CP 575-A Notice — Federal Trade Commission Business Entity The notice is for an organization to notify the Taxpayer Protections Office that it no longer maintains or maintains its own independent records or records of information (internal controls) regarding certain federal trade commission business activities. CP 575-B Notice — Public Interest Research Group The notice is for a nonprofit organization established for the purpose of conducting research and public education on specific legislative, judicial, and other matters which may concern the legal, ethical or legislative aspects of certain areas of law. No more than 25 members of the organization are eligible to participate in a public policy research program, such as a seminar or conference held by the organization. CP 575-C Notice — Taxpayer Protections and Government Transparency The notice is for a nonprofit organization established for the purpose of establishing itself and conducting financial and operational activities that will allow it to comply with all applicable requirements of the Internal Revenue Code and other applicable state and federal laws and tax rules in order to advance public interest and government transparency.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 575E for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 575E for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 575E for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 575E for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.