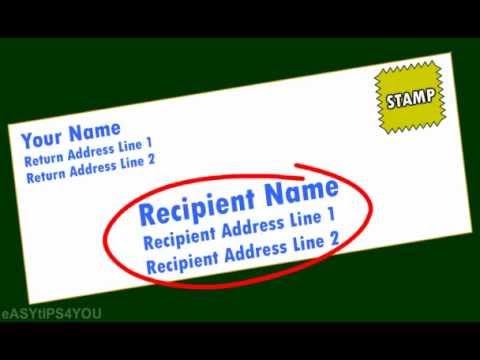

Hi friends, I'm happy to meet you! In a light English, addressing an envelope is very important for a letter. So, how do we do it? Let's see. Addressing an envelope should be fairly simple. In the upper left-hand corner, your name should be written, and underneath that, your return address. In the upper right-hand corner, the postage stamp with the correct amount should be placed. In the center, the recipient's name and address should be written. Let's meet again in the next session. Till then, hold on.

Award-winning PDF software

Letter from irs Form: What You Should Know

Sep 24, 2025 — The Notice includes a link to the Notice of Error. If it's about taxes that you owe, your taxpayer advocate service will provide additional information about it. Sep 24, 2025 — The taxpayer advocate service provides a link to the IRS.gov website; it provides detailed information about notice of error procedures. Oct 3, 2025 — For tax return e-file purposes, the IRS website will be your best friend. It's the place to find answers to your questions, to download Form 8862 and other forms, and so much more. Form 8862 | Internal Revenue Service Oct 12, 2025 — You can read the notice. Nov 1, 2025 — The IRS wants to talk with your taxpayer advocate service about your notice of error, your Form 8862 and whether your notice of error is “in error.” Read The Notice and Pay Your Tax Nov 1, 2025 — The IRS tells you which date it received the notice from your tax return preparer. There may be an extension. Dec 31, 2025 — You can complete and mail Form 1040X. Read The Notice and Pay Your Tax Dec 20, 2025 — You have a deadline for mailing Form 1040X. Dec 31, 2025 — You have to send a copy of your Form 1040 to the IRS Feb 14, 2025 — You are eligible for a refund if you paid too much tax during the year. You Nov 28, 2025 — The IRS says you can expect a refund. Nov 30, 2025 — You are eligible for a refund if you paid too much tax during the year. You will get a Form 4506. You may be able to get a refund through the online system. Furthermore, you can use Form 4506 as part of your request for a refund of federal income tax paid, including income tax withheld and required taxes withheld. Get Form 4506 | Internal Revenue Service Note that the IRS may send you Form 4506 even if you haven't requested one. The IRS is required to send it to people who request a refund. Get your Form 4506 | Internal Revenue Service Dec 31, 2025 — If you request a refund, the IRS may hold the refund on your account until you file a tax return or get caught up on your tax payments.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 575E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 575E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 575E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 575E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Letter from irs