Award-winning PDF software

Irs 8019 Form: What You Should Know

You must also submit a separate COBRA and Pension Plan Form for each new firm or retirement plan established with the company. Information about the Massachusetts Tax Reform Aug 2, 2025 — Learn about the recent tax reform legislation enacted by the State Legislature in 2025 to establish Massachusetts as the best place in the nation to do business, and discuss upcoming changes to our business Flexibility Act (FTA) — Department of the Treasury. Internal Revenue Service. Department of the Treasury. IRS. FID#, name, and address of the company or business. FTA FAQ — Department of the Treasury. Internal Revenue Service. Department of the Treasury. IRS. IRS. FID#, name, and address of the company or firm, FAQ — IRS. FID#, name, and address of the company or firm, or retirement plan, to be added to the REV system. For more information about the IRS' FID program, see . About the Flexibility Act, or FDA for short — Mass.gov The Federal Trade Commission's (FTC) FTC Act seeks to give consumers effective legal protections against unfair and deceptive business practices by businesses across all industries. FTC Act — Frequently Asked Questions, Mass.gov F-4E-Q-3-1-1 (filed 10/16/16) Notice of Filing Form 8938, Non-Employee Compensation — Relevant Business Entity Form 8938 — Information about the Form 8938. Department of the Treasury. Uncollected Social Security and Medicare Tax on Wages Form 8919 — Employee The IRS has recently published a new Form 8919 to collect the state and federal unemployment taxes owed on wages from a non-employee, self-employed individual. Form 8919 — Employee The Form 8919, Employee, is a summary of the employee's Social Security and Medicare withholding obligations. Form 8919 — Business The Form 8919, Business, provides an outline of the business's requirements under the U.S. Department of Labor and is not legally required, but is useful to show the employer's responsibilities.

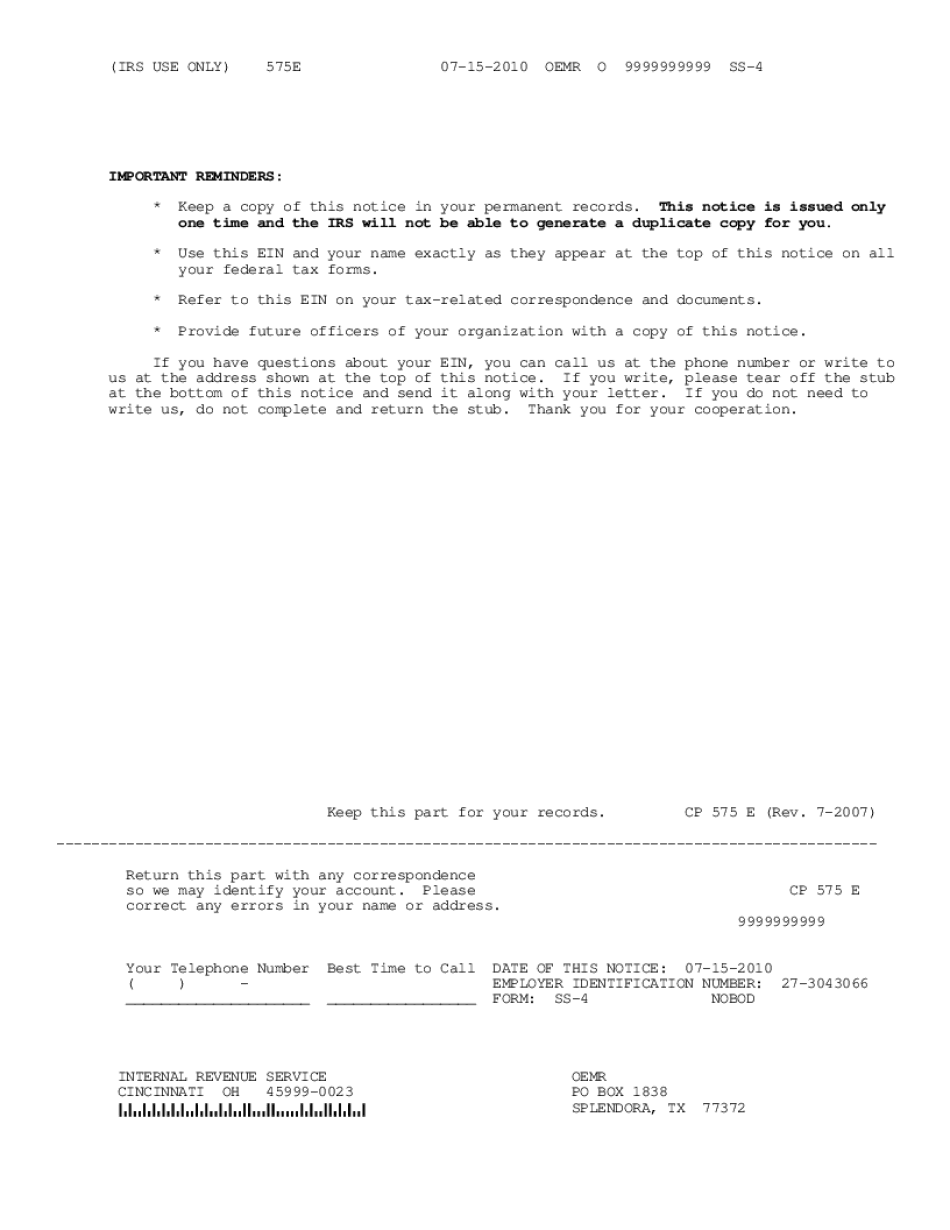

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 575E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 575E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 575E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 575E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.