Hello, it's Ty Crandall with Credit Suite. In this short video, we're going to talk about how you can get business credit cards using only your EIN, without needing your social security number. Just like you have a social security number for yourself, your business has its own identifier, which is an EIN number. Your business can also build credit using this EIN number, and when done properly, your business can qualify for credit without requiring a personal guarantee. Think of it this way: when you apply for a car loan, you can choose whether or not to add a cosigner to the application. If you add a cosigner, both your credit and their credit will be used for the approval decision. However, you can also apply for a loan without a cosigner, and in this case, only your credit will be used to determine approval. The same concept applies to business credit. On the application for credit, you can decide whether you want only your EIN credit to be evaluated, or both your social security number and EIN. If your EIN has an established credit profile and score, it can often stand alone and qualify without a personal credit check. This means you don't even need to provide your social security number on the application. There is no credit check and no personal guarantee required because the approval decision is based solely on your EIN number. To avoid a credit check and personal guarantee, make sure to leave off the social security number on the application. Credit issuers will want to see that you have a solid EIN credit profile with good business credit scores. It is important to note that many successful businesses do not have their owners as guarantors because they have built a strong credit profile...

Award-winning PDF software

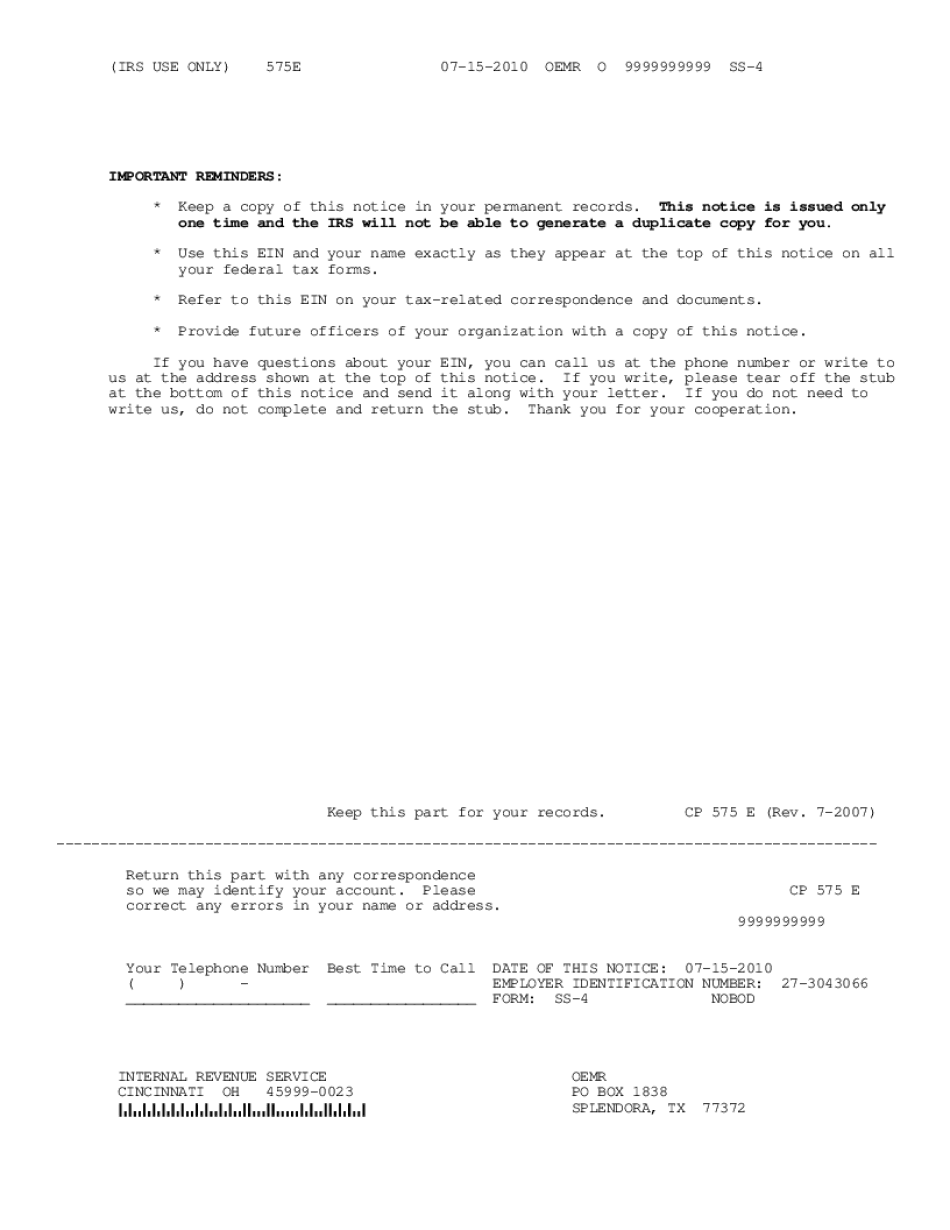

Ein verification letter Form: What You Should Know

If you filed Form 1120S, and you need a tax identification number for the refund or credit, call the IRS and request the correct identification number. In most cases, the right number is 3-digit serial number from the Internal Revenue Service (IRS). IRS Letter: IRS Form 8950 | U.S. Treasury Department I've recently opened a bank account and I have an EIN. What do I need to do to activate my EIN? | Internal Revenue Service Any person who wishes to file a tax return for an individual must have an identification number issued by the IRS if he or she is not an American citizen or a U.S. resident alien or if he or she did not claim exemptions or deductions for which he or she is eligible when he or she filed his or her federal income tax return pursuant to section 6013, 6014 or 6015 of the Internal Revenue Code (IRC). If you're an alien, you will also need a nonimmigrant visa. To activate (or keep active) your EIN, or to amend an incorrect EIN, you need to apply for an electronic taxpayer identification number (EIN). The EIN is a unique number that identifies each taxpayers' taxpayer. It is obtained by entering one's social security number (SSN) and the number (EIN) assigned by the IRS. You must update or amend your EIN if: You moved since the last tax return was filed with the United States Internal Revenue Service; You did not complete all the IRS EIN-related information on your last return; You are required to change your tax identification number (EIN) for purposes other than filing income tax returns; or You have changed your address. If you have a delinquent or invalid EIN, you can apply to have it cancelled (cancelled). You may also request an online EIN cancellation form. If you file your federal income tax return online, you can choose to activate or to update your EIN from your personal account, or by entering your social security number on the IRS' Online System (OS). IRS EIN Online Cancellation Form IRS EIN Cancellation Form | OMB How do I get my name changed on my EIN application? — Internal Revenue Service Any IRS employee can change one's name on your federal income tax return, but it will not be automatically reflected when you file your income tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 575E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 575E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 575E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 575E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ein verification letter